ARES Urbanexus Update #171

The American Real Estate Society (ARES) distributes this monthly compilation of real estate-related news and information curated by H. Pike Oliver.

Trends

ULI’s emerging trends for 2025

Now in its 46th edition, Emerging Trends in Real Estate® 2025—produced by PwC and ULI—offers forward-looking perspectives based on insights from over 2,000 real estate experts. This is a resource for understanding the year ahead, offering data-driven perspective.

Top Takeaways

Improved sentiment, continued caution: The capital markets are stabilizing, signaling opportunity for savvy investors who remain alert to risk.

Top markets to watch: Explore growth hotspots like Dallas-Fort Worth, Miami, and Houston, or movers and shakers like Manhattan, Detroit, and Columbus—markets redefining real estate through innovation and reinvention.

Sectors on the rise: Data centers are taking center stage, propelled by AI and cloud technology advances—an asset class poised for sustained demand.

Climate-related challenges: Rising insurance costs and extreme weather underscore the need for climate resilience.

Multifamily shifts: High-growth markets may face oversupply in multifamily housing.

Go here to delve into the data and analysis shaping real estate and urban development in 2025.

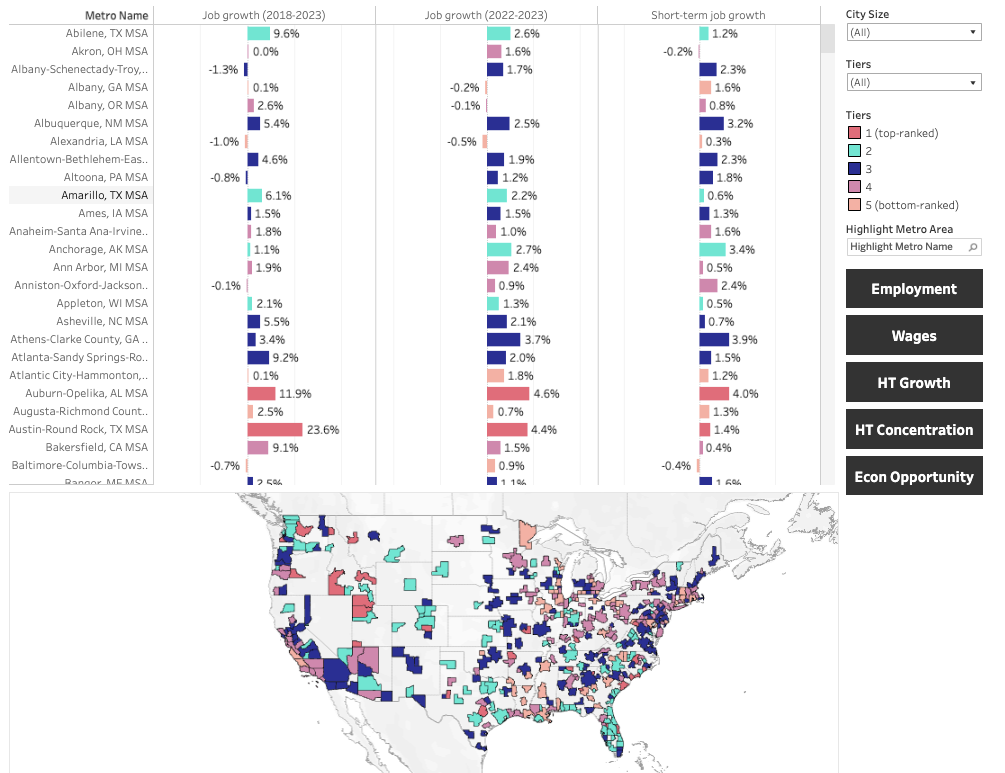

Mapping economic growth across the USA

The Milken Institute’s Best-Performing Cities (BPC) index evaluates the relative economic performance of 403 metropolitan areas, providing insight into their strengths and vulnerabilities. The BPC index utilizes 13 key metrics, combining labor market conditions, high-tech industry growth, and access to economic opportunities. This comprehensive approach captures emerging trends and significant shifts in the US economy, offering a detailed benchmark for metro performance.

Three highlights from the 2025 rankings are:

Raleigh, NC, becomes the best-performing large metropolitan area for the first time in over 10 years. The area performs in top quarter of large metros on 11 of the 13 BPC metrics.

Gainsville, GA, is this year’s best-performing small metropolitan area. This area's climb to the top this year comes on the heels of several years of strong labor market conditions.

Rise of smaller, large metro areas. There are only three metros with more than 1 million inhabitants in the list of the top 10 large areas.

You may download the full report here.

Screenshot of the interactive map, which map be accessed here. Source: Milken Institute

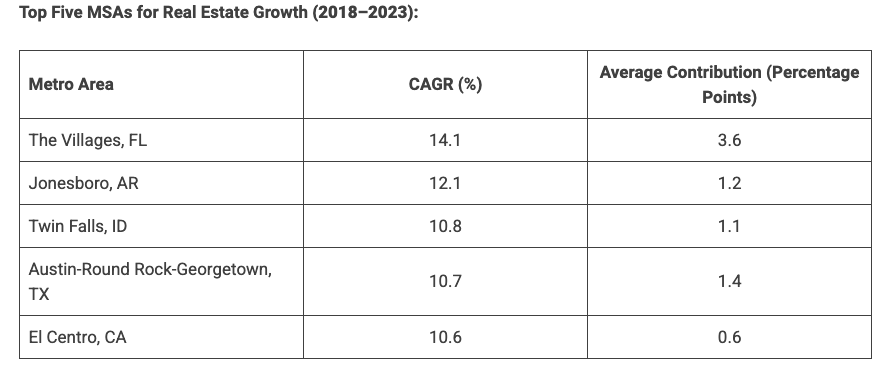

Real GDP, construction and real estate in US metropolitan areas

Real GDP of metropolitan areas rose 2.7% in 2023, with the “real estate, rental and leasing” sector contributing 0.34 percentage points and construction contracting growth by 0.11 percentage points. While many metro areas followed the national growth trend, each region has its unique economic narrative.

In 2023, real GDP increased in 348 Metropolitan Statistical Areas (MSAs), decreased in 34 MSAs, and remained unchanged in 3 MSAs, according to the U.S. Bureau of Economic Analysis (BEA). The data, which was released in December 2024, shows the range of growth spanned from 42.9% in Midland, TX, to a contraction of -9.3% in Elkhart-Goshen, IN. Three MSAs—Ithaca, NY, Joplin, MO, and Longview, WA—saw no change in real GDP.

The real estate, rental, and leasing sector also showed robust growth in many regions, with 209 MSAs experiencing positive growth during the five-year period. The Villages, FL, recorded the highest CAGR at 14.1%, reflecting its status as the nation’s largest community designed for an aging population.

Other MSAs like Jonesboro, AR, saw significant real estate growth due to proximity to Arkansas State University, while Austin-Round Rock-Georgetown, TX, benefited from a population influx because of its thriving tech economy.

Visit NAHB’s dashboard for additional data and visualizations on demographics, housing market and the economy for all metro areas.

Los Angeles wildfire recovery will be costly and lengthy

The Urban Land Institute interviewed economists, insurance executives, and disaster recovery professionals to gain their insights on the recovery and rebuilding of property and infrastructure. These experts generally conclude that solutions will likely demand substantial time, capital, and collaboration between public and private stakeholders.

Three factors drive the speed and extent of how Los Angeles will recover from this:

Infrastructure that wasn’t destroyed (the type and quality of which will determine the rebuilding base).

The will and capability of government and policymakers will drive how quickly legal issues are settled and the path forward is clarified.

The relative endowment of both public and private sectors—wealthier places with stakeholders clamoring for recovery fare better.

The Palisades and Eaton fires mainly destroyed single-family homes in the residential area (15,000 units, or roughly 75 to 85 percent of the residential structures, with the rest, about 3,500, being condos, duplexes, or multifamily rentals). Will these owners and renters relocate within Los Angeles or move out of state? Will new households move to the areas that are rebuilt? For now, there are more questions than answers.

One thing is clear: the L.A. fires will have a disproportionate impact on lower-income communities and those with limited social networks, hindering their recovery due to a lack of resources and support systems. Marginalized groups, including racial and ethnic minorities, may face additional barriers in accessing aid and housing. Renters risk displacement and face challenges in securing affordable homes.

Recovery efforts should prioritize social and physical infrastructure by strengthening community bonds through local organizations and community engagement. Equitable distribution of aid and resources is crucial to addressing the specific needs of marginalized groups and preventing discrimination.

The recent wildfires are also expected to adversely impact California's already troubled affordability and availability of home insurance. The extensive economic damage and insured losses, which could surpass $30 billion, according to Morningstar DBRS, highlight the considerable risk for property insurers, particularly in regions near wildlands.

The California insurance regulator restricted insurers' ability to increase property insurance rates and deny coverage on renewal, making it uneconomical to insure many properties in the state. This has led some major insurers to stop issuing new policies, and some homeowners can no longer get insurance and must rely on the California FAIR Plan, designed as a last resort. Recent fires only worsen this situation. If insurers cannot raise rates and decide to reduce their exposure to California further, the remaining insurers will find it increasingly challenging to provide coverage.

Learn more here.

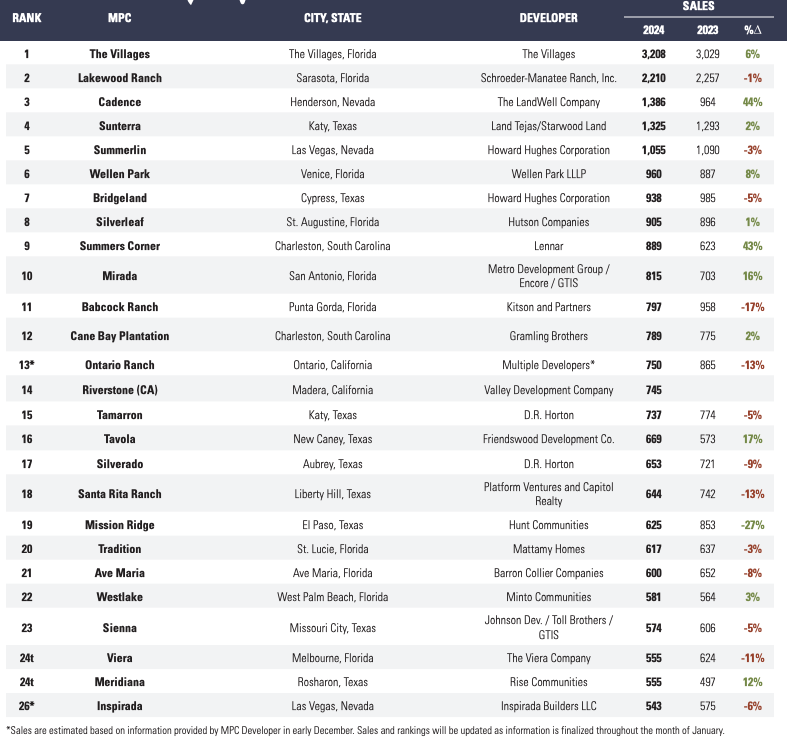

Master-planned communities

Top-selling communities of 2024

Every year since 1994, RCLCO has conducted a national survey identifying top-selling master-planned communities (MPCs) through a rigorous search of high-performing communities in each state. This initiative, now in its 31st consecutive year, exists not only to recognize the most successful communities in the country, but also as a tool for monitoring the overall health of the for-sale housing industry, and a means of highlighting the trends affecting communities large and small. This process also serves as a mechanism through which to learn development best practices and pass along lessons gleaned from the MPCs that have pioneered their way into the top ranks. That information contributes to the knowledge base utilized in RCLCO’s MPC consulting practice. In the following report, RCLCO has surveyed MPCs throughout the country to update the rankings of The Top-Selling Master-Planned Communities of Mid-Year 2024.

The chart below summarizes the top 25 of RCLCO’s list of the 50 top-selling communities of 2024, including a comparison with their home sales in 2023 where applicable. Sales among the Top 50 communities were just 2% below the pace set by 2023 top-sellers. Considering the challenges seen throughout the year – from election uncertainty to severe weather events, as well as continued affordability concerns and “sticky” mortgage rates – this relative consistency among top-sellers highlights the resiliency of homebuyer demand and the perceived advantage of new homes in general and master-planned communities specifically.

Learn more here.

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

A century-old master-planned community in Florida

In a Substack post, the founder of California Planning & Development Report, Bill Fulton, shares observations from a visit to Venice, Florida, on the Gulf Coast near Sarasota. Fulton notes, “The famous plan by John Nolen is fine, but the way the city has unexpectedly evolved over the last Century – disrupted by bankruptcies, the Depression, and a period of forgetting all about Nolen and the town’s history – has actually made it a richer experience and a more interesting place. The Nolen plan provided a strong and enduring foundation for a town that evolved, at least partly, in an unexpected way.”

Fulton goes on to explain, “Nolen had a formalistic approach to urban design (you can see that in the image of the town plan below), and he fell out of favor in the mid-20th Century when a more informal suburban approach advocated by such rivals as Clarence Stein became popular. (You can read all about this rivalry and why Nolen fell out of favor in Bill Fulton’s book Place and Prosperity, specifically Chapter 3, “The Garden Suburb and the New Urbanism.”)”

See the article "What A Century-Old Planned Community In Florida Can Teach Us About The Future Of Where” for an explanation of how Venice, Florida, evolved, some of it differently from what Nolen envisioned.

Residential

The cost of building in 2024

Construction costs account for 64.4% of the average price of a home, according to NAHB’s most recent Cost of Construction Survey. In 2022, the share was 3.6 points lower, at 60.8%. The latest finding marks a record high for construction costs since the inception of the series in 1998 and the fifth instance where construction costs represented over 60% of the total sales price.

The completed lot was the second largest cost, representing 13.7% of the sales price, a decrease of more than four percentage points from 17.8% in 2022. The proportion of a finished lot in the total sales price has consistently declined over the last three surveys, reaching a record low in 2024. That said, land costs can represent a more significant portion of total costs, particularly in high-cost coastal markets.

The average builder profit margin stood at 11.0% in 2024, up less than a percentage point from 10.1% in 2022.

At 5.7% in 2024, overhead and general expenses increased compared to 2022 (5.1%). The remainder of the average home sale price consisted of sales commissions (2.8%), financing costs (1.5%), and marketing costs (0.8%). Marketing costs remained unchanged, while sales commissions and financing costs decreased compared to their 2022 figures.

Construction costs were categorized into eight major stages. Interior finishes represented the largest portion of construction costs, at 24.1%, followed by major system rough-ins (19.2%), framing (16.6%), exterior finishes (13.4%), foundations (10.5%), site work (7.6%), final steps (6.5%), and other costs (2.1%).

Learn more here.

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

The eternal, essential apartment

Apartments. Flats. Units. Regardless of what you call them, these individual dwellings, usually found in multistory buildings, have existed for thousands of years. Their prevalence adds vibrancy to the urban landscapes that characterize cities like Tokyo, New York City, and Rome, destinations famous for their distinct cityscapes that attract residents and visitors.

One example of a multi-unit residential building from the ancient world was the Roman insula, or “apartment block.” While not as grand or luxurious as the Domus (a private, single-family townhouse), multi-story insulae were important structures in crowded Roman cities. In a time before elevators, ground-floor and lower-level apartments were the most desirable. In the Americas, the ancient city of Teotihuacan, located near modern-day Mexico City, was characterized by numerous apartment compounds at its height. These compounds were essential to Teotihuacan’s urban structure, allowing approximately 200,000 people to live closely together in the city.

In the twenty-first century, the design of apartment structures must confront the climate crisis and other evolving environmental factors, even as we continue to build larger and taller buildings.

Learn more here.

Office

Trends shaping corporate real estate in 2025

Global real estate services firm JLL (Jones Lang LaSalle) has issued a brief report identifying three significant trends that will reshape how organizations approach workplace strategies and real estate decisions.

Portfolio transformation in a post-hybrid era. As the practice of 3-4 days in the workplace becomes the norm, firms will balance space optimization with plans for future portfolio growth.

Artificial intelligence (AI) and data readiness. Most organizations are early in the maturity curve and will need a multifaceted strategy to capitalize on the promise of AI.

Technology and AI skills and delivering value. CRE (corporate real estate) leaders must fundamentally reimagine and reinvent their roles, capabilities, and competencies to remain relevant and drive strategic value for their organizations.

You may download the report here.

Federal office space and DOGE

Although several directives made by President Donald Trump since his inauguration have uncertain outcomes, one being watched by the commercial real estate industry is whether — and how — a charge for the federal government to cut spending will affect its national space portfolio.

The General Services Administration, which oversees the federal government's roughly 360 million-square-foot portfolio, could be a target of the cost-reduction efforts led by Trump's newly formed Department of Government Efficiency. Trump has already ordered remote federal government workers back to the office full-time. That, alongside a hiring freeze issued for vacant positions, are moves likely intended to cull the number of federal workers.

According to a recent analysis by commercial real estate data firm Trepp, the federal government currently leases 149.39 million square feet of office space across the nation, with rent payments totaling $5.23 billion annually. According to the agency, the GSA owns and leases more than 363 million square feet of space in 8,397 buildings nationally.

An analysis by The Business Journals of a December filing tlisting the GSA'sreal estate inventory found 1that 1,715 of the agency'slisted leases nationally are set to expire in 2025 and 2026, totaling at least 47 million square feet. With Trump back in the White House, it's likely the GSA's space reductions will accelerate.

Learn more here.

Conversion of office and parking on the Irvine Ranch in Southern California

The Irvine Company has plans to convert a portion of the MacArthur Court office complex in Newport Beach, CA, into housing.

The project would transform approximately 107,000 square feet of office space at 4665 and 4685 MacArthur Court into 700 apartments. Plans also call for redeveloping surface parking areas with approximately 678,000 square feet of residential space in a pair of five-story buildings, accompanied by a five-level parking structure.

At the exterior, the development would incorporate a new lawn area for community activities, connecting the residential and office areas of the campus. Roughly 37,000 square feet of recreation space is planned. The project would retain 603,000 square feet of office space at MacArthur Court when completed.

Google Maps - Location of MacArthur Court in the greater Los Angeles area

MacArthur Court - Source: The Irvine Company

Mixed use

Minerva in Belgium

In the Belgian municipality of Edegem, just a 20-minute bike ride from Antwerp’s city center, a brownfield site that once stored camera film has become a biodiverse, sustainable mixed-use residential and commercial neighborhood that has received Global Award for Excellence from the Urban Land Institute.

The Minerva automobile company started building a factory in Edegem in the 1920s. During World War II, German forces commandeered the site for aircraft repairs, which led to a deadly bombing raid. Later, AGFA-Gevaert took over the facility to use it for cutting and packing camera film. When operations ceased, the buildings remained unused until 2016, when developer Revive purchased the brownfield site to create a community with homes for 330 families.

Developer: Revive

Master planner: Architecten Achtergael

Designers: POLO, ECTV architects, Areal Architects, Architecten Achtergael, Denc! Studio

Site size: 14.83 acres

Date opened: March 1, 2023

Anticipated completion: December 31, 2026

Buildings: 365,973 square feet

Parking (# of spaces): 350

Open space: 289,549 square feet

Minerve offers a range of housing types, from social housing to cohousing options, featuring ample social spaces for gathering. This includes one residential building with a communal rooftop terrace and another that functions as a community hub with a thrift store, restaurant, and meeting space. More than half of the units are designated as affordable for intermediate-income households.

A district heating network uses residual heat from the neighboring AGFA-Gevaert factory to supply domestic heating and hot water, significantly reducing energy costs and fossil fuel dependency. Rainwater from Minerve and the surrounding neighborhoods is collected in a 422,675-gallon (1.6-million-liter) water storage buffer and reused for toilet flushing and garden irrigation, reducing the area's impact on the sewage system. The water is also redistributed to industrial partners and municipalities. Water-absorbing plant borders and three ravines facilitate soil infiltration.

Construction relied heavily on recycled materials, such as repurposed bricks and reclaimed wood for decking. The selection of native plants, the incorporation of nesting opportunities for bats and swifts, and the reduction of disruptive lighting enhance the area's biodiversity. To further minimize environmental impact, Minerve offers residents communal electric cars, electric cargo bikes, and easy access to public transportation

Learn more here.

Oblique aerial view of Minerva - Source: Urban Land Institute

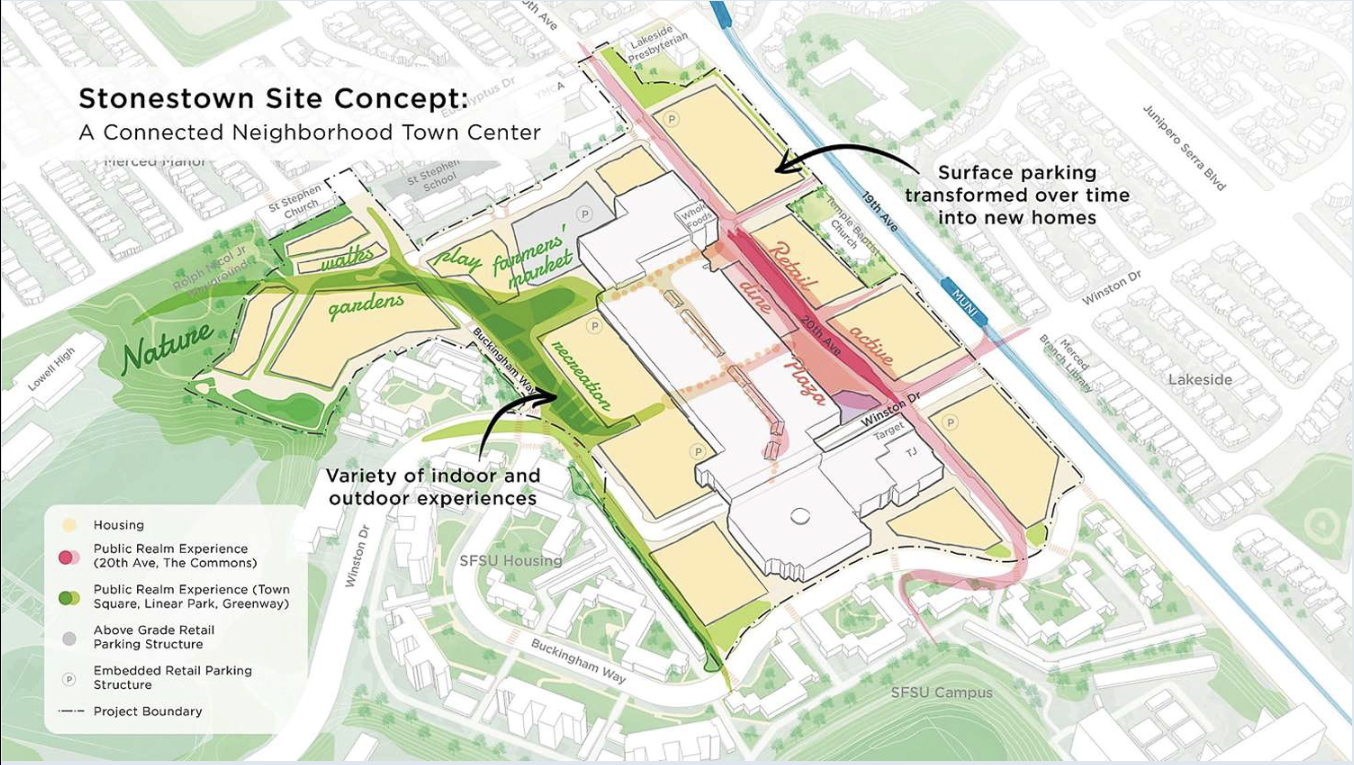

Stonestown redevelopment in San Francisco

The developer, Brookfield, submitted to the City of San Francisco an application for a Special Use District to redevelop a 30-acre property that was originally developed as a shopping center in 1952. The site was initially called Stonestown Shopping Center before undergoing significant redevelopment in 1987 and being renamed Stonestown Galleria. San Francisco State University (which has approximately 20,000 students) is just south of the Stonestown site.

The plan involves transforming the parking areas into a mixed-use hub that preserves the mall while incorporating residential, retail, office, and community spaces. In February 2024, the San Francisco Office of Controller and Economic Analysis published an Economic Impact Report for the Stonestown Mixed-Use Development. Five months later, The San Francisco Board of Supervisors unanimously approved the redevelopment plan.

Project Details:

Site Size: Approximately 30 acres

New Housing: 3,419 units, 20% of which will be affordable (687 units).

Existing retail space of 775,000 sq. ft. to remain

New Non-Residential Space: Includes 96,000 sq. ft. of office and 160,000 sq. ft. of retail space.

Community Amenities:

A childcare facility for 100 children.

A 7,000 sq. ft. senior center.

Streetscape and open space improvements (6 acres of publicly accessible private open space).

Enhancements to Rolph Nicol Jr. Playground and $1 million for additional upgrades.

Economic Impact:

Construction and Spending:

$1.6 billion in construction costs over 25 years.

Expected to generate significant construction jobs and economic activity.

Housing Effects:

Expected to reduce citywide housing prices slightly by 1.3%.

Affordable units will save tenants an estimated $5.4 million annually in housing costs.

Employment:

Long-term creation of 901 jobs (403 office, 435 retail, 63 childcare).

Retail Impact:

The loss of surface parking spaces may reduce mall retail sales, but new residential demand could offset losses.

Broader Economic Effects:

Citywide Growth:

An average increase of 870 jobs annually over 20 years.

A $228 million boost to San Francisco's GDP.

Housing prices relative to the U.S. are expected to decline by 0.2%.

Phased Development:

It is anticipated to occur in six phases over 25 years, with timelines influenced by market conditions and financing availability.

Learn more and view renderings here.

Location of Stonestown in San Francisco - Source: Google Earth

Site concept - Source: Brookfield Properties

Regional and metropolitan trends

Startups and VCs betting on the Valley of the Sun

Greater Phoenix is no longer just a low-cost retirement destination — it's now home to one of the largest and most vibrant startup communities in the U.S. The region's commitment to a diverse economy, advanced tech policies and entrepreneurial support has positioned it as a major player in next-generation industries.

Key numbers:

Greater Phoenix currently ranks 7th among U.S. cities with the most startups, according to the Arizona Technology Council.

The region's startups range from early- to later-stage companies like WebPT, Trainual, Paradox, Carvana, Emerge, Offerpad, Persefoni, Lessen and Virtuous.

The region is now home to more than 100,000 tech employees.

Maricopa County leads the U.S. in talent attraction, ranking 7th in 2023 on Lightcast's annual Talent Attraction Scorecard.

Idealab Arizona, in partnership with Arizona State University, launched a startup studio to drive innovation in climate, medical, AI and advanced manufacturing.

Phoenix ranks as a Top 50 Global Startup City based on its size and maturity.

In 2023, non-debt VC and equity financing deals surged by 58%, reaching $1.7 billion.

Since 2018, the region has generated $7.7 billion across the software, health care, internet services, and sustainability industries.

The state's Angel Tax Credit program aims to boost early-stage investments in small businesses by offering tax credits to investors.

With the creation and growth of venture funds over the past several years, the region is now home to key VC firms like AZ-VC and PHX Ventures, accelerating the region's competitiveness for investment and innovation.

Learn more here and visit the Startup Ecosystem Dashboard to learn more about the region's landscape, funding milestones, job opportunities, and startup success stories.